As the coronavirus runs rampant, its underlying impact on our economy continues to grow. From the immense health concerns to the incredible amount of job losses, the economic strain impacts all corners of society. With proper guidance and mitigation, many economists predict a “V” shaped recovery, where jobs and consumption return in full force following containment of the virus. However, future consumption does not help companies today! As a result, there are many small business grant programs aimed at providing financial resources to get through the storm. Additionally, as the Covid-19 pandemic continues to course through the economic veins of the country, consumption hits some starts and stops. Local economies fluctuate based on state and country regulations, which seems to hinder the “V” shape recovery. However, the impact of reduced consumption continues to hurt all aspects of the economy.

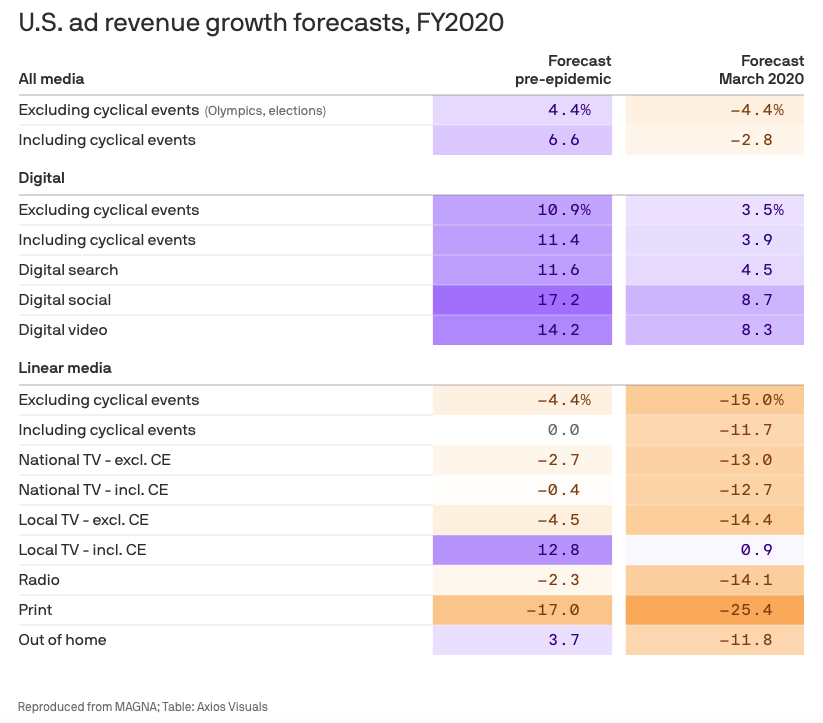

The downstream impact of this economic downturn, which indeed hurts virtually every industry, includes advertisers. As lack of consumption occurs, companies cut back on investing in advertisements, which in turn hurts the ad companies (and ultimately, their employees). Axios highlights the coronavirus impact on the ad space.

Additionally, eMarketer supports the reduction in ad spend. Furthermore, eMarketer notes the impact that retail advertisers have on the market.

“Notably, retail advertisers—which make up the largest share of display spending—will boost these investments by just $300 million this year, in spite of increased ecommerce spending by consumers. We estimate total US retail sales will fall by 10.5% this year.”

Advertising revenue tends to align with GDP, which makes inherent sense. As the economy grows, companies increase their advertising budget accordingly. In the US, we have experienced a dramatic bull market over the last decade, which helps foster the advertising growth rate over the last few years as well. However, now, analysts at Cowen & Co., predict that big tech companies will take the brunt of the decrease in ad spend.

- Facebook: roughly $15.7 billion (down 18.8% from original estimate)

- Google: roughly $28.6 billion (down 18.3% from original estimate)

- Twitter: roughly $701 million (down 17.9% from original estimate)

- Snapchat: roughly $977 million (down 31.8% from original estimate)

Why do analysts believe these tech platforms will suffer more than other ad platforms?

First, most advertisers on these platforms are self-service small business. The gym down the street or the local clothing boutique sign up and spend small amounts on Facebook and Google. Axios notes how the self-serve functionality impacts the spend.

“They are self-serve, meaning anyone can buy those ads through an automated platform at any time without a prepared contract. As a result, unlike with TV ad contracts, there are no cancellation policies that brands have to adhere to when pulling the plug.”

Additionally, small businesses are severely impacted because most of these local establishments operate on tight margins. And although some of the federal stimulus relief are aimed at these companies, they are specifically targeted at payroll and utilities. Vincent Letang, executive vice president and director of global forecasting at Magna Global describes the small business impact on tech platforms.

“Hundreds of thousands of small businesses who probably count for 70% of social and search, they will stop advertising for weeks as they are closed. For some of them, it will be hard to come back, as many won’t have liquidity to start marketing.”

Finally, although analysts predict a large hit on the ad tech platforms, large agencies are not immune as well. In fact, many of the largest advertising agencies forecast a severe pull back on spend as a result of the coronavirus. For example, Publicis Groupe anticipates a worse decline than the 10% plunge during the financial crisis. Additionally, Omnicom anticipates budget cuts and furloughs. Plus, WPP froze all hiring with possible layoffs or furloughs to come in the future. Also, Dentsu reduced pay by 10%, along with furloughs and layoffs across the agency due to a reduction in client spend.

Google Unveils Free Shopping

As the competition for mindshare picks up, Google made an evolutionary announcement allowing organic listings within Google Shopping. For product-centric companies (both large and small), Google Shopping remains an effective and efficient way to generate sales. The Shopping feed, which is distinct from the AdWords marketplace, enables companies to list products and Google serves products to potential consumers based on search queries. Although there is limited management within Shopping, the option provides a direct to consumer experience and serves products directly related to consumer intent. As a result, Google Shopping generally delivered high quality return on ad spend for companies.

Search Engine Land, which highlighted the announcement noted that Google Shopping was originally free (or listed organic results) prior to shifting to a paid-only platform in 2012.

“Two things have changed since that time: data quality and Amazon. Before going entirely paid, Google’s product search suffered from a quality problem — with listings that often led to out of stock or entirely different items altogether. Google’s ability to ensure that the information in a product feed matches the data on the site has advanced significantly since then. Then there’s Amazon. Google has seen the e-commerce giant continue to gain share in product search and advertising. Limiting the universe of products available in Google Shopping results to those retailers who are willing to pay has put Google’s search power at a disadvantage.”

As marketers learn more and Google offers additional information, the Shopping tab will likely mirror traditional SERP results. So, moving forward, Shopping will include paid and organic product listings. Additionally, it appears that the carousel of product listing ads (PLAs) displayed on the main Search page will continue as is (and solely consist of ads).

In the official announcement, Google noted the change is directly related to helping companies connect with consumers (regardless of advertising on Google). As search volume increases (due to more people at home), the move enables Google to allow customers to find merchants with the products they need. Google identified the benefits for each party:

- Retailers gain free exposure to consumers conducting product searches on Google.

- Shoppers gain exposure to more stores and products.

- Advertisers increase reach with paid and organic listings.

Additionally, Google announced a partnership with PayPal that aims at improving the onboarding process.

“We’re also kicking off a new partnership with PayPal to allow merchants to link their accounts. This will speed up our onboarding process and ensure we’re surfacing the highest quality results for our users. And we’re continuing to work closely with many of our existing partners that help merchants manage their products and inventory, including Shopify, WooCommerce, and BigCommerce, to make digital commerce more accessible for businesses of all sizes. “

Although additional organic exposure helps merchants, many industry pundits see the changes as directly targeting consumer purchasing behavior on Amazon. Typically, consumers view Google for researching and Amazon for purchasing products. So, with the expected reduction in ad spend (Google’s bread and butter), the changes likely forecast Google’s intentions to source and convert purchases directly.

Finally, the announcement further supports the focus on creating and maintaining a comprehensive digital marketing strategy. Leveraging the best digital marketing practices, would include Google Shopping as part of your advertising program (if your company sells products) due to the superior return on investment. So, this announcement does not impact your spend (in theory), but ideally supplements your return by increasing organic purchases. A comprehensive digital marketing program aligns the SEM and SEO components of operating a Shopping feed to help consumers find your products!